Welcome to The Main Street Minute, your shortcut to small business buying and scaling. Today, we’re diving into 6 real-world frameworks used by business buyers and builders in our programs.

Here’s what you’ll get out of today’s newsletter:

But first…

Next week, at our free business growth masterclass, you can learn tactics like these live, from the comfort of your own home. But you need to act soon:

Now let’s dive in…

START HERE

1. How He Jumped the Line in a Competitive 30-Buyer Process

In 2025, Jesus closed a fascinating deal following a year-long grind that included:

Reviewing 1,000+ businesses for sale

Signing 200+ NDAs

Reviewing hundreds of financial statements

Submitting multiple offers

And ultimately acquiring a $7M-revenue, multi-location manufacturing business in a niche most have probably never thought about before.

The deal he closed was not found through a listing. It came through a relationship with a broker built on a different deal that did not close.

“The broker liked me. Not because I had the highest offer, but because he trusted I could actually close quickly.”

In a competitive process with 30 buyers, some of them institutional, Jesus jumped the line. Not on price, but on credibility.

“My offer was lower than others. But they believed in me as a buyer.”

He didn’t win that deal. But the relationship paid off. Later on, that same broker brought him something off-market before sharing it with the world.

“He said, ‘Before I send this out, do you want to look at it?’ I looked at it and thought, ‘This is it.’ At that point, I knew what a good deal looked like.”

Because of the reps he had put in, Jesus could move fast.

“I didn’t need it to go to market. I put in an offer immediately.”

2. The 50% Rule: How to Take Action Without Clarity

The market usually rewards execution velocity more than theoretical readiness.

Over time, our member Dave developed a rule around this. If he understands roughly half of what needs to be done and trusts his ability to learn the rest in motion, that’s sufficient to proceed.

Waiting for 80% or 100% clarity only delays feedback and compounds opportunity cost. This rule governed the earliest days of his business.

Dave admits he understood almost nothing about his industry when he launched his company. What he did trust was his ability to problem-solve inside regulated environments.

“Even if you’re not 100% sure about what needs to be done or how to do it, if you’re 80% sure, that’s pretty solid. If you’re 50%, you can make it happen. When I started, I knew maybe 5% of what had to happen. Mistakes are recoverable.”

Action beats inaction because action creates data.

3. Understanding the Risk of the Owner’s Bottleneck

For years, Jimmy handled sales himself. Not because it was strategic, but because it worked. “I spent about 25 hours a week in a sales capacity.”

Deals closed. Revenue grew. But growth was capped by his calendar.

At a Contrarian Thinking workshop earlier this year, our goal was to help Jimmy identify his company’s biggest constraint. It didn’t take long.

“They were like, ‘We’re going to help you uncover your biggest problem.’ And my office manager Mark looks at me and goes, ‘You know that you are the biggest problem.’”

Jimmy listened, and quite literally priced it out. “When I backed into the math, I realized I was looking at a roughly $750,000 problem.”

That number reflected his time spent on sales, and the opportunity cost of delayed growth and higher-leverage work left undone because the business still needed him on the phone.

“I began thinking about how to really systematize this,” Jimmy told us.

“I recorded every single sales phone call. I took all the transcripts, dropped them into ChatGPT over the course of about three months,” he said. “And then I developed a one-pager that shared our entire value proposition.”

Sales stopped being instinctual and became repeatable.

That realization helped reshape Jimmy’s go-to-market strategy, sales priorities, and growth focus, and the results have been remarkable.

“We have signed contracts worth an annualized gross revenue of $934,000,” he told us. “I’ve already seen about 50% of that impact hit our top line this year.”

4. How to Turn Your Biggest Expense Into a Cash-Flowing Asset

For over 25 years, Alex has built a career as a magician.

He wanted to buy a business to supplement his income, but he wasn’t sure what type of business would be right for him.

He had no obvious experience in the service industries that often dominate acquisitions.

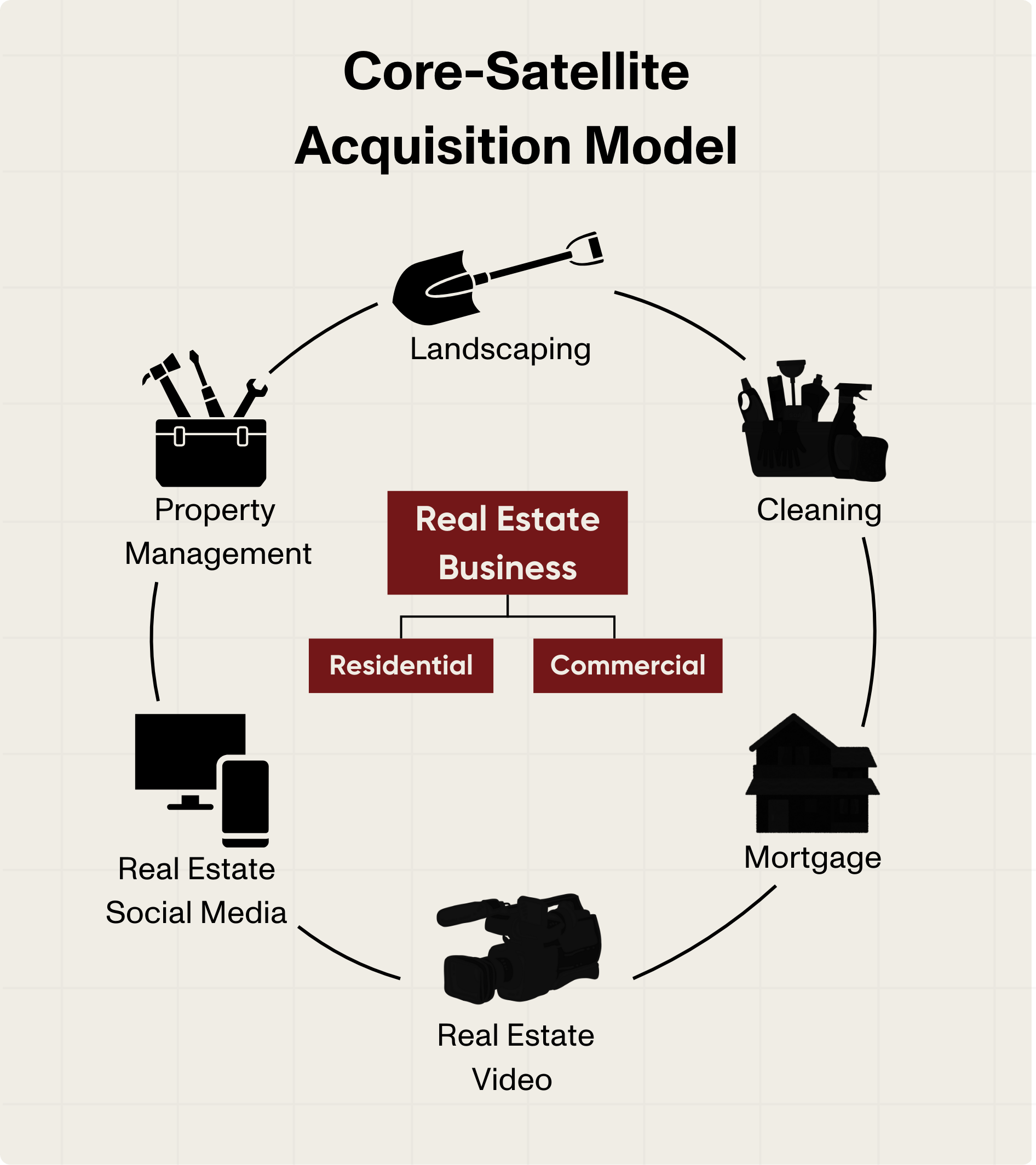

But there’s a strategy we love called the Satellite Acquisition Model, and it’s how some of the smartest owners escape the trap of linear growth.

Ideally, you have one successful, core business. But instead of letting that business stand alone forever, you find complementary businesses to pair with it.

Example: A real estate company could strategically acquire:

A property management company

A social media agency

A video production agency

A landscaping company

A mortgage brokerage

Suddenly, the line items that used to be expenses are now positioned to be long-term profit centers.

For Alex, that answer was clear. After his shows, he sold branded merchandise. Think: shirts, hats, beanies, tote bags, and other souvenirs for his audience. Every year, he spent a significant amount of money simply stocking up on inventory.

That realization led him to a custom branding and merchandise company just 35 minutes from his home in Lake Tahoe. The business checked all the boxes.

“The owner had been running it for 23 years, was in his 70s, and was ready to retire. The employees had been there for over a decade. It was a perfect fit.”

But getting the deal done wasn’t easy. It never is.

5. The 10x ROI of Being in the Right Room

If you want to know where future fortunes will be made, don’t look at markets; look at rooms.

Why? Wealth follows proximity. The closer you are to capital, information, and ambition, the higher your expected return.

Economists call it agglomeration, the phenomenon where productivity and innovation rise as people and ideas cluster together.

By the time Kelly joined our programs, she already had a relatively established firm and a clear operational base, with acquisitions ranging from just $35k to about $750k.

Each deal taught her something different:

How to retain legacy clients

How to absorb staff

How to clean up old systems

How to handle seller transitions

How to merge books of business without losing quality

How to spot red flags faster

But over time, she also learned that she felt something else: isolation.

Stepping into a “room” of people who understood her business’s challenges changed how she thought about acquisitions mechanically and how she managed hurdles mentally.

“I didn’t quite understand that I’d be able to bolt a larger acquisition into what I already have… That confidence came from learning that what I had in place was actually pretty good.”

Larger acquisitions… Building an empire… These didn’t feel like a stretch anymore. They felt within reach.

6. The Right and Wrong Questions to Ask When Buying a Business

Here it is. The perfect business to buy… C’mon. You know better. There is NO such thing as a “perfect” business to buy. If someone tells you there is, joke’s on you. Still, the question pops up all the time:

Wrong question. The right one is:

That’s exactly how Olman and Jen started: with a brutally honest look at their Zone of Genius.

See, the best deals align with things like:

What you can realistically operate and grow into

What fits your lifestyle and goals

What you’re willing and able to sacrifice

What meets your financial needs

Olman and Jen didn’t just “stumble” into their med spa and get it on track to $1M+.

They used this lens to filter what might be a fit, instead of chasing whatever niche was “trending.” Could a laundromat work? Eh. A property management business? Not really. But then Olman had a thought…

One day, Jen, a nurse, went to a med spa. Her treatment took 20 minutes and cost $800. Olman did the math. “I started thinking maybe this is a good business to get into…”

So they started digging. What they found was an industry full of high-margin services, but also inefficiencies everywhere. Things like:

Vague pricing

Outdated marketing

Sloppy operations

In other words, lots of room to improve.

But spotting an opportunity is one thing. Figuring out how to step into it is another…

Want to join thousands of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join our Contrarian Academy or Growth Boardroom.

IMPORTANT

Ready to Learn How to Buy a Business? Start Here.

It’s not rocket science, but there is a science to this. At Main Street Millionaire Live, we’ll help you save time, understand how to do this the right way, and take action with a clear plan:

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our partnership opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.