Welcome to The Main Street Minute, your shortcut to small business buying and scaling. Today, we’re diving into a fascinating 7-figure manufacturing business acquisition.

Here’s what you’ll get out of today’s newsletter:

But first…

At Main Street Millionaire Live, you can learn tactics like these (and much, much more), live, from the comfort of your own home. But you need to act soon:

Now let’s dive in…

START HERE

From Corporate Finance to Buying a 7-Figure Manufacturing Business

Jesus Wong did everything right.

Sixteen years in finance and accounting. Senior roles. Great salary. The kind of corporate resume that signals “made it.” And yet, something felt off.

“It wasn’t an itch. An itch is just a small scratch. This felt like a yearning. I needed to take on something and grow it. To call it my own.”

That feeling eventually pushed him to walk away from corporate life with nothing lined up. No deal. No backup job. No income. Just a belief that ownership would deliver something a paycheck never could.

What followed was a year-long grind that included:

Reviewing 1,000+ businesses for sale

Signing 200+ NDAs

Reviewing hundreds of financial statements

Submitting multiple offers

And ultimately acquiring a $7M-revenue, multi-location manufacturing business in a niche most have probably never thought about before.

This is the story of exactly how he got there. And more importantly, what his process can teach anyone trying to buy a business in 2026.

GETTING STARTED

Making The Leap from a Corporate 9-5

When Jesus left his corporate role, he assumed he would start something from scratch. That assumption didn’t last long.

“I didn’t realize how hard it is to start something. I spent a bunch of energy and resources on a few ideas and quickly realized starting something would take a long time, and that there was a lot of risk involved because of that.”

That risk mattered more because he had no income coming in. So he started asking a different question: instead of building from zero, could he buy something that already worked? That idea led him toward the world of small business acquisitions. He dove in completely.

Jesus treated learning about acquisitions like a full-time job. “I read a bunch of books,” he told us. “I listened to every episode of Acquiring Minds. All 300 of them.” Then, he treated searching for a business like a job, too.

A NUMBERS GAME

1,000 Deals Later: The Volume Advantage

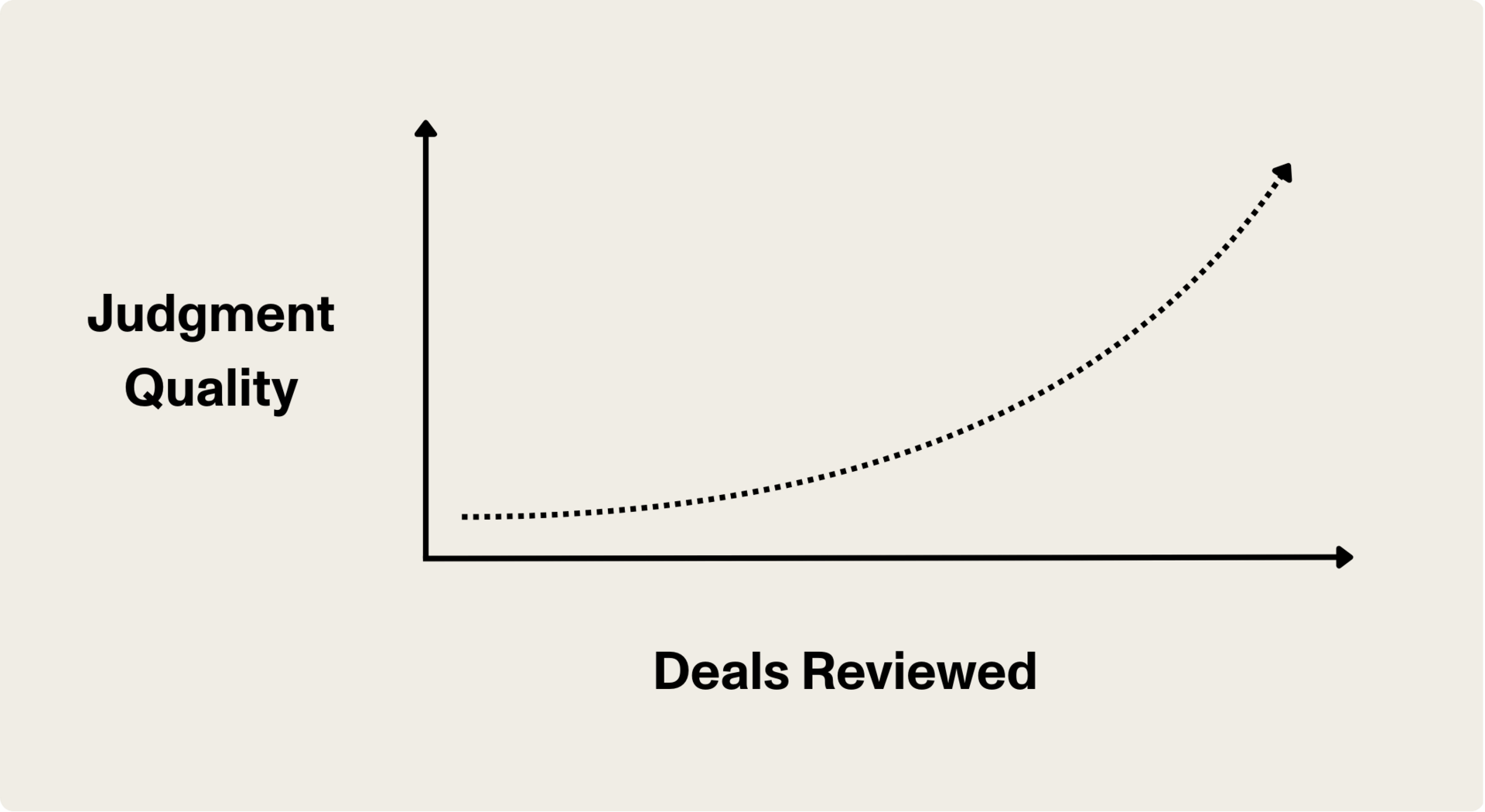

Most buyers underestimate how many reps this actually takes. Jesus did not.

“I looked at over a thousand businesses. I signed around 200 NDAs. I reviewed that many financials. I spoke with tons of brokers, lawyers, accountants, and sellers. I did site visits. I sent a bunch of offers.”

Sure, that’s not always necessary. But here’s why it can be helpful anyway. Over time, Jesus developed pattern recognition through volume, and in doing so learned more about what he did and didn’t want to buy.

He joined the Contrarian Academy in mid-2024. By the end of the year, he had an accepted LOI. Six months of focused search, with learnings that completely reshaped his perspective.

How His Deal Box Changed Completely

Early on, Jesus assumed “smaller” meant safer. It is a common trap.

Fine for some, but as he worked through deal after deal, his criteria evolved:

He moved up-market to larger businesses

He became industry agnostic

He expanded geography beyond where he lived

He prioritized structure, team, and durability over simplicity

“After months of modeling tons and tons of deals, I developed a better sense of key things that were important to me, like mitigating risk and ensuring that I’m setting myself up for success. That meant looking at larger businesses and deals.”

KEY LEVER

How He Jumped the Line in a 30-Buyer Process

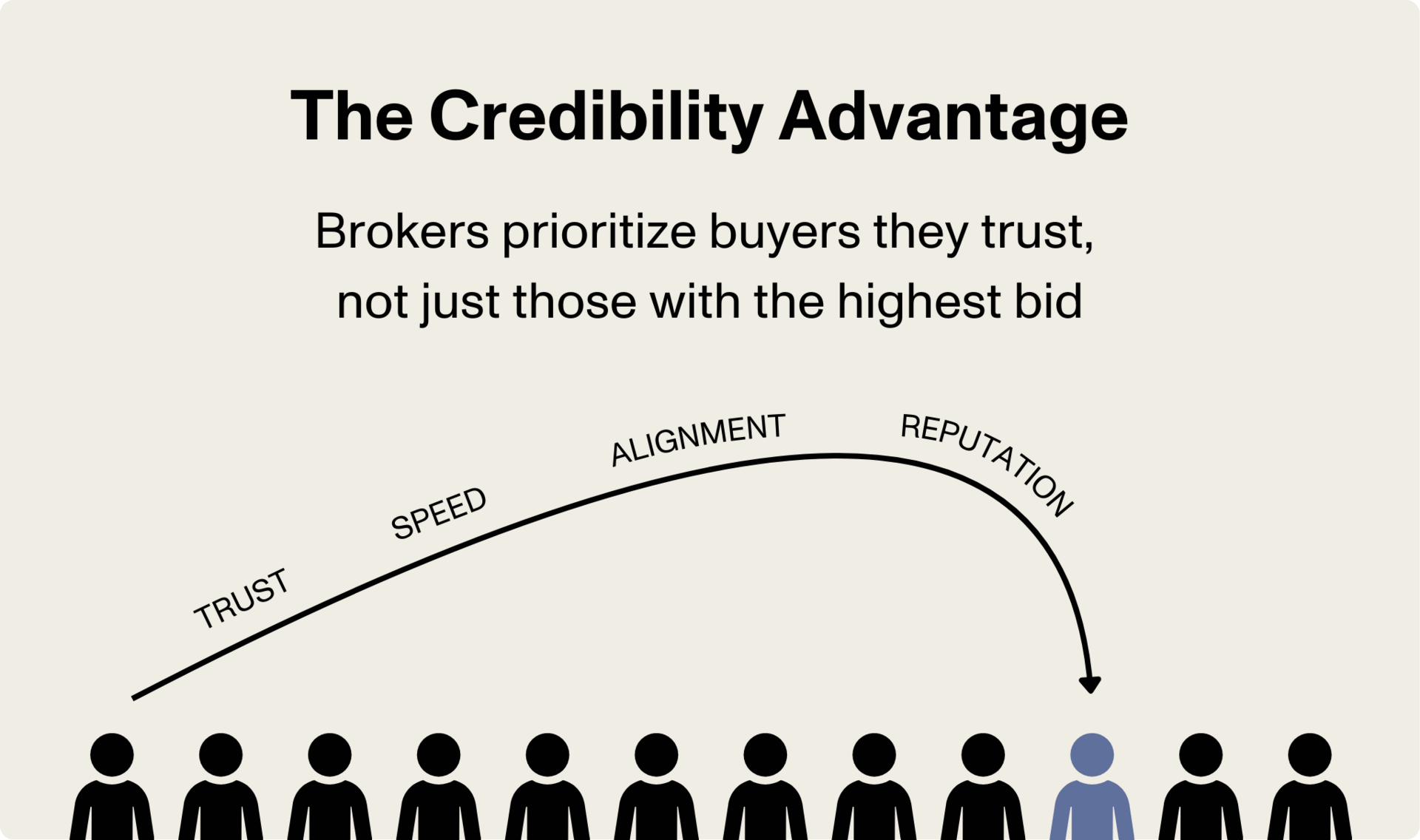

The deal Jesus closed was not found through a listing. It came through a relationship with a broker built on a different deal that did not close.

“The broker liked me. Not because I had the highest offer, but because he trusted I could actually close quickly.”

In a competitive process with 30 buyers, some of them institutional, Jesus jumped the line. Not on price, but on credibility.

“My offer was lower than others. But they believed in me as a buyer.”

He didn’t win that deal. But the relationship paid off. Later on, that same broker brought him something off-market before sharing it with the world.

“He said, ‘Before I send this out, do you want to look at it?’ I looked at it and thought, this is it. At that point, I knew what a good deal looked like. I didn’t need it to go to market. I put in an offer immediately.”

Because of the reps he had put in, Jesus could move fast.

KEY TACTIC

How He Protected Downside Without Killing the Deal

The business Jesus acquired was not 100% bulletproof. No business ever is. Key risk factors included:

Key customer concentration

85+ employees to manage

Multi-location, international operations

Remote ownership across multiple regions

HR, management, and inventory complexity

Rather than avoiding these risks entirely, Jesus structured the deal around them.

The Structure That Made the Deal Work

This deal required creativity. Jesus needed downside protection without scaring off the seller. So he built a layered structure:

A seller note with forgivable, performance-based components

A profit-share upside that heavily favored the seller early on if the business outperformed

“If profitability hits certain targets, they get paid. If it doesn’t, that portion is forgiven. If the business doubles and they take most of the profits for a few years, I still own a much bigger business. I’m okay with that trade.”

The structure did three things:

Protected Jesus from downside risk

Let the seller hit their valuation goals

Aligned incentives post-close

That alignment mattered more to Jesus than squeezing every dollar upfront.

THE BUSINESS

What to Know About the Business He Bought

Jesus now owns Gear Restore, which he told us is the largest technical garment repair company in North America.

They repair and restore outdoor and performance apparel for major, high-end outdoor apparel brands. These brands run warranty programs. Gear Restore is the infrastructure behind them. “We fix technical garments. Outdoor gear. Ski jackets. Climbing gear. We’re a B2B business.”

The 85+ person company, which operates 3 facilities across Calgary, Denver, and Philadelphia, also serves major ski resorts, maintaining uniforms during off-season months.

Gear Restore also sits at the center of a larger, growing trend: “Upcycling. Circular economy work. Keeping products out of landfills,” as Jesus put it.

Brands need partners who can execute this work at scale, and that creates durable demand.

KEY LESSONS

What He Wants You to Know Before You Start

Despite the strength of the business, the ownership transition has not been easy.

“I came from a white-collar environment. This is blue-collar, hands-on work. The toughest thing at first was getting used to such a large workforce.”

Jesus spent his first months mostly listening.

“Eyes and ears wide open. Learning the key success factors. Understanding challenges. Only just now, months later, am I starting to implement new initiatives.”

When asked what he would tell someone starting this journey, Jesus did not hesitate:

1. Define Your “Why” Early

The ownership process is mentally and physically demanding. Without a clear purpose, the stress compounds fast.

“This whole process is stressful and tough on the psyche. You’re not going to push through unless you have a big why.”

Jesus compares it to training in the gym. “You’re not going to go to the gym every single day unless you have a big why. Maybe it’s your kids. Maybe it’s your health. That’s what makes the effort feel worth it. If you understand what actually drives you, the ups and downs won’t feel as overwhelming or mentally taxing.”

2. Relationships Are a Huge Factor

Jesus won it by being a trusted buyer.

“Be able to sell yourself in every aspect. Treat everyone well, be human, be a good person. My deal came through a relationship. It’s not about being a super negotiator. It’s about being real. Why are you the right person for that business. You’re selling yourself to brokers, lawyers, and accountants, too. They need confidence in you to put in their best effort.”

Jesus didn’t cheap out on a deal team. In fact, he built it methodically and carefully.

“I interviewed ten lawyers and picked one. I interviewed a bunch of accountants. I used a loan advisor. I stacked my team intentionally. I’d rather pay upfront than find a massive issue at the eleventh hour because I didn’t have the right people in the room.”

3. Commit to Putting in the Reps

Jesus’s confidence came from volume.

“You need to put the reps in. I went through as much as I could. I started thinking I’d buy something small. After reviewing so many businesses, my criteria completely changed.”

For him, repetition built intuition. “It’s like training a muscle. When you’ve modeled enough deals, you start picking up on things instinctively. You see patterns faster because you’ve seen so much.”

4. Don’t Do This Alone

This journey is isolating without the right people around you. For Jesus, community created accountability and momentum.

“I was super engaged in the community early in my journey. The concepts, analyzing deals, the mindset, the ability to assess risk, and surrounding yourself with like-minded friends and advisors... It’s really, really cool.”

Want to join thousands of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join our Contrarian Academy or Growth Boardroom.

IMPORTANT

Ready to Learn How to Buy a Business? Start Here.

It’s not rocket science, but there is a science to this. At Main Street Millionaire Live, we’ll help you save time, understand how to do this the right way, and take action with a clear plan:

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our partnership opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.