Welcome to The Main Street Minute, your shortcut to small business buying and scaling.

👋 Huge shout-out to the new readers who joined the newsletter last week.

Reminder: When you’re ready to get to work, we designed these tools just for you…

BizScout to buy or sell a biz

Contrarian Academy for acquisition advisory

Growth Boardroom to scale your business

…But tools are only as effective as the person using them.

If you want to accelerate your acquisition proficiency, we’re doing something in February that we think you’ll really love.

Main Street Millionaire Live is our world-class, 100% virtual, 3-day technical intensive designed to compress the acquisitions learning curve.

Over 72 hours, we’ll immerse you in the mechanics of dealmaking: sourcing off-market deals, validating financials, negotiating with sellers, and structuring terms.

Depending on your needs, attendees have viewed this as perhaps the single most valuable dollar-for-dollar event we offer:

“It contained so much useful information and a roadmap for me to move forward with my goal... Fantastic insight into the nuts and bolts of what to do and how to go about acquiring a business.” -K.B.

“This wasn’t just another hype-filled event. It was packed with real, actionable strategies and hands-on workshops. Codie and the team poured so much value into every session, and the energy in the room was next level.” -Adam C.

“As someone who has spent over two decades in corporate, I have wasted time on many superfluous events and workshops, and this was nothing like that. I left exceeding my objectives.” -Marivel S.

“The entire team cares a lot about everyone’s success. That said, this is for people who are action-oriented, willing to put in the reps, and are disciplined towards reaching their goals. When Codie says that buying a business is hard, she’s telling the truth.” -Jabari H.

Main Street Millionaire Live is taking place February 20th-22nd. But our most affordable pricing (just $47) will likely end on January 5th. See you there?

Now, onto today’s story…

START HERE

How 1 Acquisition Turned His Biggest Expense Into a Cash-Flowing Asset

1 Strategy With Potential Across Any Industry…

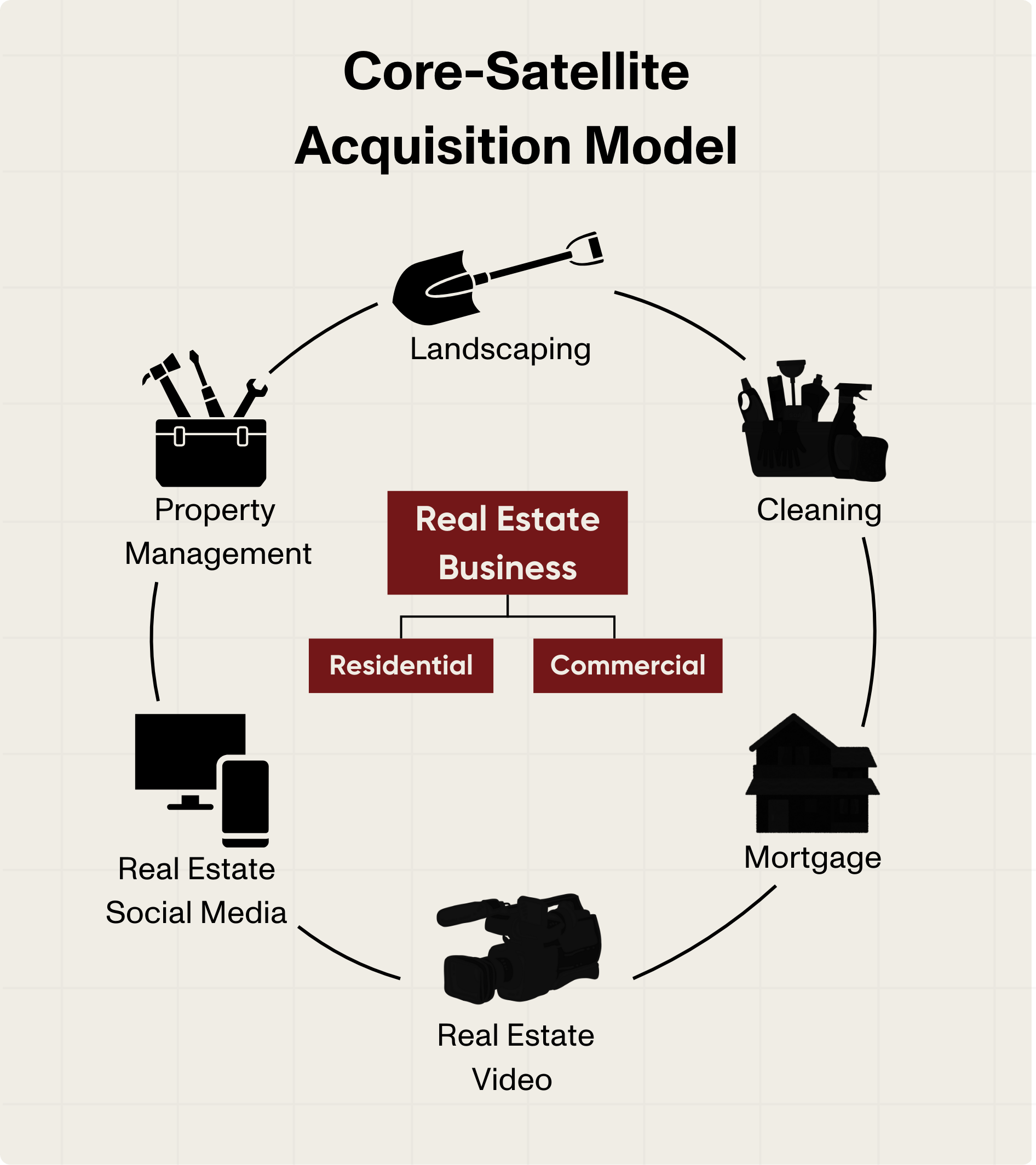

There’s a strategy we love called the Satellite Acquisition Model, and it’s how some of the smartest owners escape the trap of linear growth.

Ideally, you have one successful, core business. But instead of letting that business stand alone forever, you find complementary businesses to pair with it.

Example: A real estate company could strategically acquire:

A property management company

A social media agency

A video production agency

A landscaping company

A mortgage brokerage

Suddenly, the line items that used to be expenses are now positioned to be long-term profit centers.

Let's look at how 3 other industries could use this model, and then we’ll show you exactly how 1 member of our community executed this with a 20+ year-old firm.

1. The Laundromat

Most people see a laundromat as a simple business: washers, dryers, and quarters. But the biggest thinkers might see a foundation for multiple revenue streams:

Acquire the vending machines (soap + snacks).

Launch a wash & fold service.

Acquire a fleet to offer pickup & delivery.

Buy the property and rent out the extra commercial spaces.

Sell private-label products (acquire a vendor?)

2. The Coffee Business

The Average Order Value (AOV) of a coffee shop is notoriously low. Think about it this way: $5 for a latte = 200 customers just to crack $1,000 in sales for the day. Satellites can help solve the volume problem by increasing the overall basket size and adding new lines:

Add a bakery/kitchen/catering (or partner with a local one).

Buy the laundromat down the street, so they grab a drink while they wait.

Don’t just buy beans; buy the roastery to control the supply chain. (Obviously, easier said than done.)

We visited Atlas Coffee Club a while back and loved learning how the founder, Michael, thinks about this:

Basically, he’s found ways to cross-sell to current customers AND tap new markets at the same time.

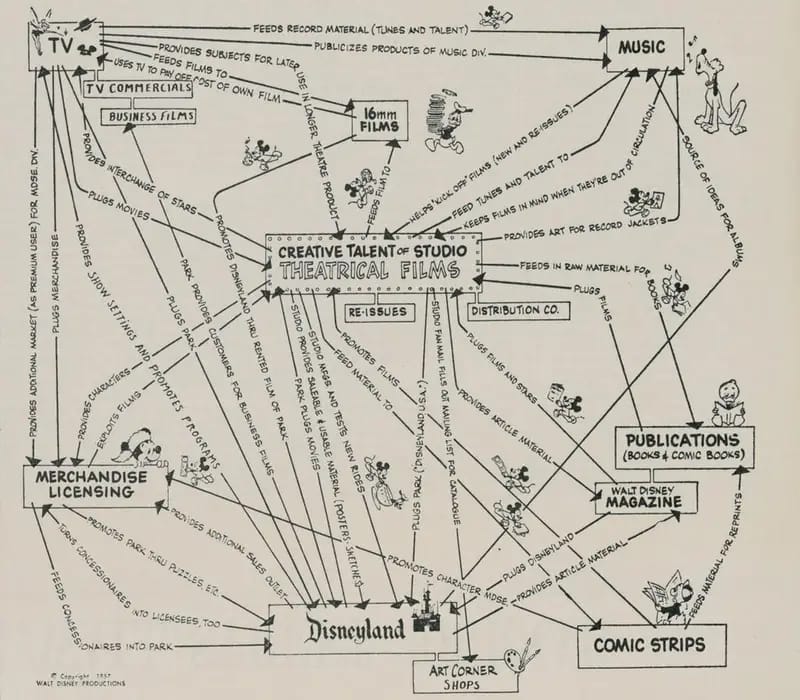

3. Disney (The GOAT)

In 1923, it was just Walt and Roy making short cartoons in a garage. But they realized early on that every piece of content was an opportunity for satellites.

The Disney Magic:

It starts with film, TV, and actors that capture hearts.

Which leads to a park attraction.

Families need hotels near the parks.

Which sells vacation packages and cruises.

While the merch follows you home.

But You Don’t Need to Be Disney

The beauty of the Satellite Model is that you don’t need to be a media conglomerate to do it. The type of business doesn’t matter: gym, dog grooming, accounting, interior design, consulting, etc.

What matters is your ability to add complementary value to your core competency.

One person who figured out how to do this really well is Alex Ramon.

THE PROBLEM

A Common Trap: “Strong Net Worth but Weak Cash Flow”

For over 25 years, Alex Ramon has built a career as a magician. With a residency in Lake Tahoe performing 5 nights a week, he’s spent his life mastering entertainment.

But over time, while his craft generated income, he began to realize something was missing: cash flow independence.

“I had some investments. Real estate, stocks, mutual funds, even crypto. But while all of those can help build my net worth. They don’t necessarily put cash in my pocket.”

Unlike other asset classes, Alex figured, business ownership may help fund his lifestyle while continuing to build long-term wealth potential.

That’s when he discovered our Contrarian Academy, where the idea of buying a small business as a challenging but realistic strategy first clicked.

“I joined the Academy, and I was surrounded by like-minded people. Everyone has their own approach. Some were looking to be owner-operators, and others, like me, wanted to be owner-investors.”

(By the way, Codie spoke to Alex on her podcast. You can listen to the entire conversation here.)

THE SEARCH

The 18-Month Grind to Secure a 23-Year-Old Asset

At first, Alex wasn’t sure what type of business would be right for him. He had no obvious experience in the service industries that often dominate small business acquisitions.

But Codie gave him a simple yet game-changing piece of advice: “Look at your bank statements. See what you’re spending the most money on, and maybe look to acquire something in that space.” We call this the “Venmo Challenge.”

For Alex, that answer was clear. After his shows, he sold branded merchandise. Think: shirts, hats, beanies, tote bags, and other souvenirs for his audience. Every year, he spent a significant amount of money simply stocking up on inventory.

That realization led him to a custom branding and merchandise company just 35 minutes from his home in Lake Tahoe. The business checked all the boxes.

“The owner had been running it for 23 years, was in his 70s, and was ready to retire. The employees had been there for over a decade. It was a perfect fit.”

But getting the deal done wasn’t easy. It never is.

“It took 18 months to close. At one point, the seller signed a purchase agreement with another buyer, and I lost the deal. Then a few months later, I get a call from the broker saying, ‘Hey, do you want to put in another offer?’”

Despite the setbacks, Alex stayed patient, got the acquisition over the line, and became the new owner of the business.

“Being part of the Academy gave me the tools, the education, and the lessons to create my deal box and acquire a business.”

GROWTH LEVERS

Capturing the Margin: The Benefits of Vertical Integration

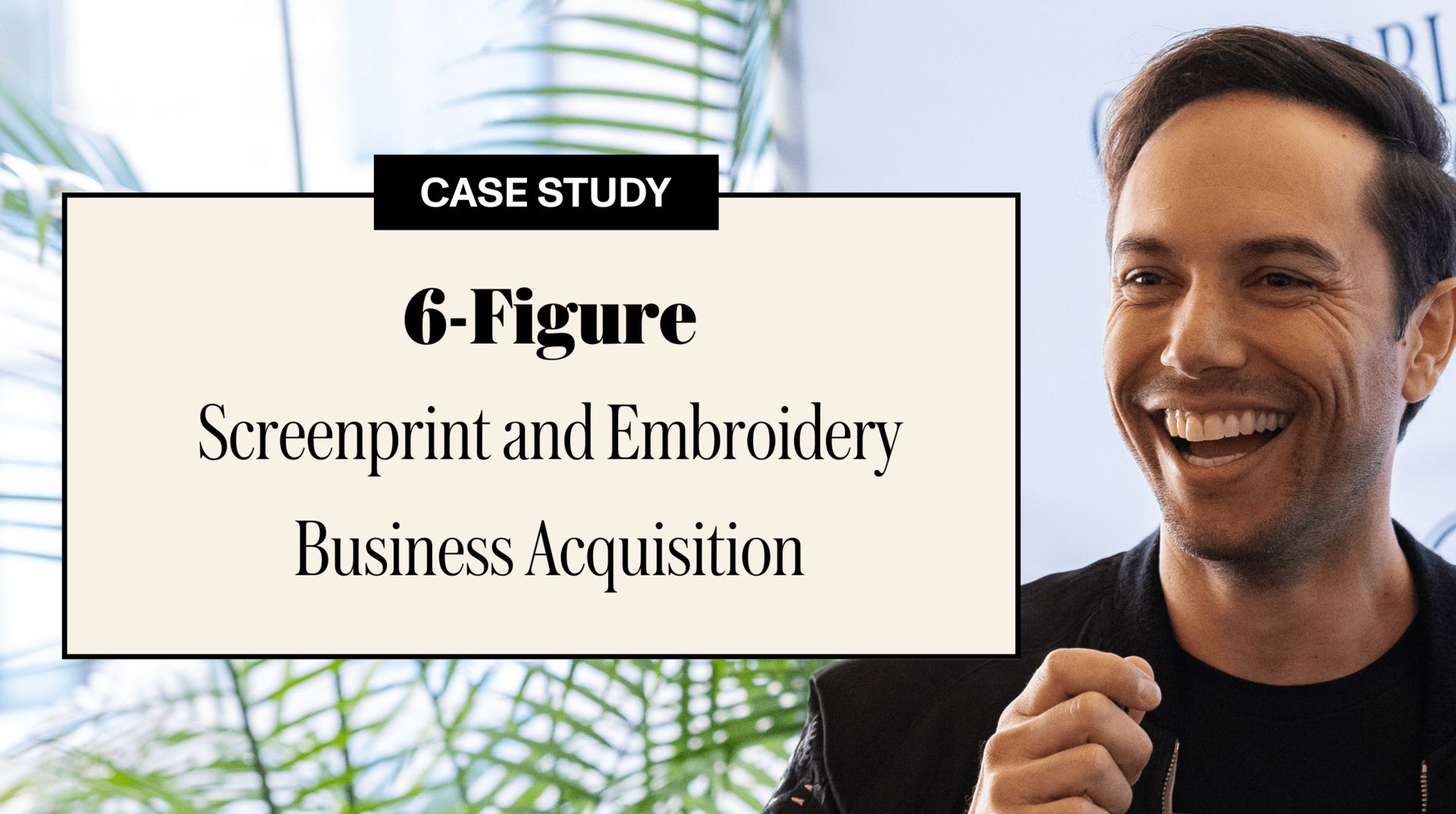

Today, the business, which employed around a dozen employees when we spoke to Alex, offers a wide range of custom branding solutions, including:

Screen printing & embroidery for team sports, corporate clients, and small businesses

Branded promotional products like water bottles, golf balls, and pens

Merchandise fulfillment & e-commerce solutions for brands and influencers

The business has also grown within Contrarian Thinking itself. “We do a lot of Contrarian Thinking’s merch now. The BizScout hats, Contrarian Thinking conference gear, Main Street Millionaire bandanas, book swag packs, and more.”

“It’s pretty cool to not only learn from the community but to have them support the business I bought because of them.”

He’s also leveraging his connections in the entertainment industry to expand into merch drops with influencers and touring artists, another “satellite” the business never pursued before.

“I’m using my network to connect with people who have a huge following,” he says. “We handle all the fulfillment, so they don’t have to worry about shipping or inventory. That’s something we’re really excited about.”

KEY RESULTS

1 Way He’s Managing Liquidity in a Volatile Economic Cycle

While Alex is energized about the future, he’s approaching the past year with caution.

“I have optimism, but I’m also a pragmatist. I think we’re going to start seeing the results of the past couple of years economically, and I want to be prepared for that.”

For him, that means tightening cash management, holding off on big upgrades, and ensuring financial efficiency before making major capital investments.

At the same time, growth opportunities are emerging.

“I found out we qualified to join a purchasing conglomerate. That’s something we couldn’t access before, because we weren’t big enough,” he says. “That’s going to lower our cost of goods and give us access to bigger suppliers like Adidas and Nike.”

Despite the uncertainty in the economy, Alex is playing the long game.

“There will be challenges, no doubt. But business comes in waves. Sometimes you ride a high wave to the shore, sometimes you paddle out and wait. The key is making sure you’re positioned to catch the next wave when it comes.”

Want to join thousands of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join our Contrarian Academy or Growth Boardroom.

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our partnership opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.