Welcome to The Main Street Minute, your shortcut to small business buying and scaling.

Today’s case study:

Inside today’s story:

Why partnering made a deal for a $10M+ business possible

How corporate skills can translate to running an SMB

Why going bigger can actually reduce risk in deals

Let's dive in below. Reply to let us know what you think. We read every message.

JOIN THIS LIVE CALL

On Thursday, we’ll show you how to do deals like this:

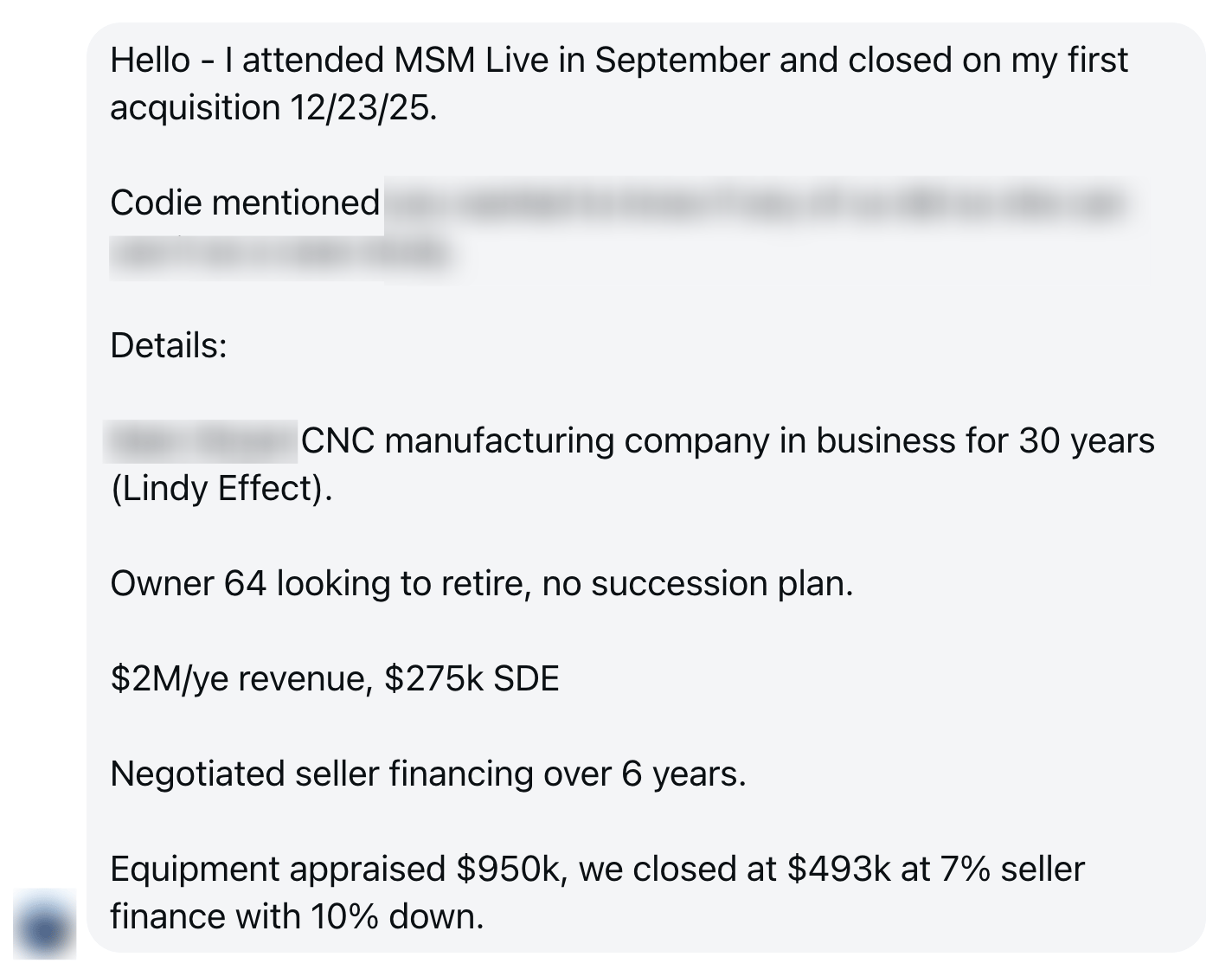

Josh came to our last event to learn how to buy a business. Look what happened next:

Pretty cool, right? Not easy, but still possible.

👉 This Thursday, we’ll show you how to do deals like this. You’ll learn about smart, affordable structures, aligned incentives, realistic timelines, and terms sellers actually agree to. Learn more and save your spot now.

START HERE

"I grew up watching my dad own a small business. About 10 years ago, I started thinking, ‘Man, how can I do that too?’"

Meet Dave.

Dave is a mechanical engineer by training. Spent 15 years inside Big Pharma, running capital-intensive projects, overseeing construction and risk mitigation, and managing large teams.

On paper, it was a rock-solid career. Stable. Well paid. Room to grow.

But something never quite lined up.

Dave grew up in a small business household. His dad rebuilt and refinished pianos in a shop at the house. Dave worked alongside him, saw the work ethic, saw what it meant to own something.

"I was the generation that got pushed toward college," he told us. "I was good at math and science, so engineering made sense,” he said.

“But I always had this feeling of, how do I build something of my own?”

For years, he didn’t really have an answer. He didn’t think he’d ever “invent” anything. He didn’t have a specific trade skill he could go out and sell. The idea of starting from scratch felt unrealistic. But then he learned about the possibility of buying an existing business.

"I thought, okay, this makes a lot of sense. I know a lot of businesses. I hire a lot of businesses for services in my day job."

So Dave joined the Contrarian Academy in July 2023. What followed was a 14-month search that ended with the acquisition of a long-running $10M+ industrial services company.

This biz spans multiple divisions, dozens of employees, and a customer list that includes refineries, chocolate producers, power generation plants, and life science manufacturers.

He didn't do it alone. He ended up partnering with a capital-backed investor, whom the broker introduced him to in the process.

And after about a year of ownership, Dave and his team:

Grew revenue in year one

Navigated key man risk when employees retired right after closing

Built recruiting systems to strengthen the team

Are on track to grow sales by roughly 50%

This is the story of how corporate experience translated to ownership, and why the right partnership made all the difference.

KEY DECISION

Why He Partnered With a “Stranger” on a $10M+ Deal

Dave made it through early due diligence on the deal. But then there was a problem.

“I was planning to do it with an SBA loan,” he said. “And the sellers just didn’t think the debt structure would work.”

The sellers weren’t questioning Dave’s ability to operate the business. They were questioning whether the deal would actually be secure. That’s when something unusual happened.

The broker told Dave that another buyer had found the deal. He had capital backing. Deal experience. A lower-leverage structure. But he needed an operator.

“They asked if I’d be interested in coming in as a partner,” Dave said. “Expertise for equity.”

It wasn’t an easy yes.

Dave would be leaving a stable corporate job. Taking a short-term financial hit. Wiring real money. And stepping into a partnership with people he didn’t really know yet.

So they got to know each other and developed a thorough operating agreement. At one point, Dave was close to walking away over governance and downside protections, but they made it work.

The final structure included:

Two operating partners running the business day to day

A capital partner backing the deal

A small board for accountability, not bureaucracy

Enough equity for Dave to justify walking away from his job

In September 2024, the deal closed. Dave now had the scale, support, and structure to focus on taking the business to the next level.

THE BUSINESS

How This 8-Figure Business is Actually Structured

Schmidt isn't one business. It's multiple.

Schmidt and Sons, started in 1948, makes ASME pressure vessels. Big industrial tanks for refineries and chemical plants.

Wagner Machine is a custom machine shop doing precision work.

Engineered Resin Solutions handles field coating with chemical-resistant epoxies.

And McCarter is an equipment manufacturer for chocolate brands. "That is a big growth area for us right now, actually," Dave told us.

To most people, this would feel foreign. Dave felt more or less right at home.

"To me, it’s like managing a facility, and that's all I did when I was in pharma. Managing facilities and equipment."

When Dave arrived, the business was well run but stale. The previous owners had stopped investing in technology and stopped chasing new accounts.

Dave and his partner saw the opportunity immediately.

EARLY MOVES

Dave’s 2 Key Focuses Early On

Dave and his partner came in with two big goals.

First: meet every major customer. Make sure they knew who the new owners were and that nothing would change for the worse.

"We wanted to hit our core customers and let them know we're not taking their business for granted."

They started showing up at customer sites. Taking people to lunch. Something the previous owners hadn’t invested in doing.

"We'd show up at some of our customers, and they'd go, ‘Whoa, okay, no one comes and sees us anymore.’"

In some cases, this inadvertently opened new opportunities for doing more business. For example, some customers who'd been buying coatings from them for 20 years didn't even know they had a machine shop, Dave told us.

The second priority was systems. The previous owners ran everything well, but hadn’t innovated much in years.

"They were still doing paper time cards every week," as Dave put it.

Dave and his partner moved fast on this. They switched to Paylocity for automated payroll and HR. Started implementing modern ERP systems. Got a new website up. Created branding that didn't exist before.

"You'd be surprised what that does. T-shirts, hats, gear for the team. None of that existed."

KEY LESSONS

3 Things He'd Tell Anyone Looking to Do This

After a year of ownership, here's what Dave wishes he'd known:

1. Don't be afraid to get a partner

"I really think that's been my biggest lesson learned. There's just no way I'd be able to do this without my current business partner."

Could he have kept the business stable on his own? Maybe. But growing it the way they're growing it? Not likely, he says.

"What we think we could do in a year as partners, I probably could have done in seven years alone."

2. Trust your gut on deals

Before Schmidt, Dave spent time on another opportunity. But it had zero management structure. The two owners did everything. Literally everything.

"I went through diligence. I should have quit on it much earlier, but I kept going."

The lesson: "If it doesn't pass the smell test, it’s probably not worth your time.”

3. Going bigger can be much less risky

This might sound counterintuitive, but Dave found the $10M+ business less risky than a $1M business would have been.

"We had some retirements right off the bat, so we had key man risk pretty early on."

Things like these are common risks when buying businesses, but they sting less when the business is larger.

"Part of our goal this year is stepping back even more as owners and letting our leaders lead."

Building a strong recruiting pipeline is key to doing that.

Dave has spent much of his time recruiting and building teams. As a company, they’re refining their approach to talent, including by using professional recruiters instead of relying on job boards.

And it’s made a huge difference.

WHAT'S NEXT

How They're Planning to Double the Business

Dave and his partner are executing on major growth initiatives right now.

After 18 months of ownership, Dave says 2025 marks a record sales year across the business.

On the talent side, they've gotten creative. Beyond traditional recruiting, they've engaged with a US Navy program to find trade talent and help rebuild America’s maritime industrial base.

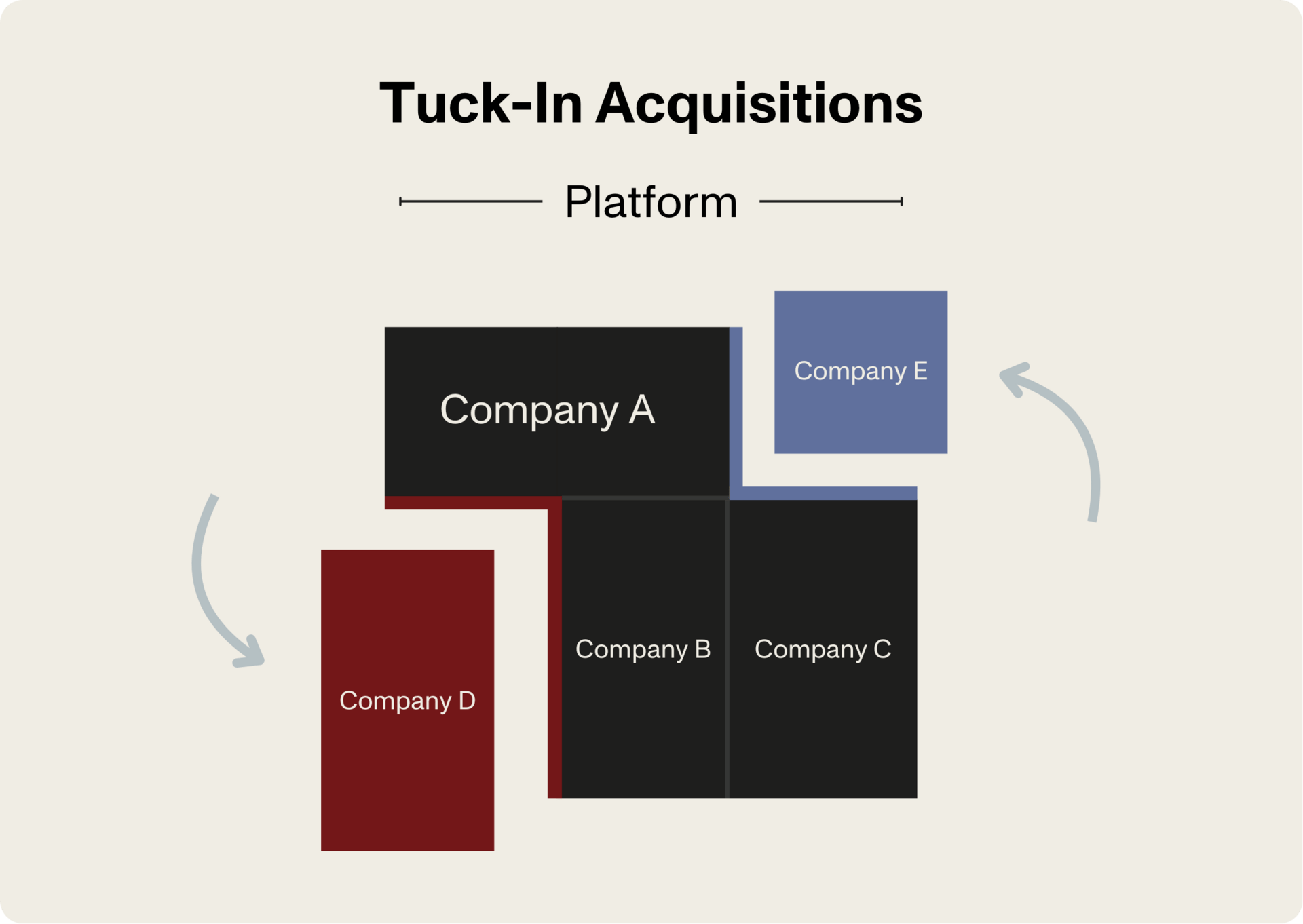

And one of the biggest developments is on the acquisition front.

They're under contract for their first strategic acquisition, set to close in March, and they already have a second target in early discussions.

Both are off-market deals that align with their existing skill sets.

If both close in 2026, they'll grow consolidated sales by roughly 50% and expand from 35 employees to around 50.

"We're still grinding, bringing in new customers and categories, and building out teams to replace my partner and me," Dave told us.

"Energy is high right now across the business."

Stepping back, this means Dave has gone from an employee to an owner to a potential multi-acquirer in just a couple of years.

And we can’t wait to see what things look like for him in another couple.

FROM THE COMMUNITY

Buying businesses is hard. That’s why we love celebrating our members when they make progress. Here are some wins from the last 30 days:

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our partnership opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.