Welcome to The Main Street Minute, your shortcut to small business buying and scaling.

👋 Huge shout-out to the new readers who joined the newsletter last week.

Reminder: When you’re ready to get to work, we designed these tools just for you…

BizScout to buy or sell a biz

Contrarian Academy for acquisition advisory

Growth Boardroom to scale your business

…But this one is the most urgent:

Tomorrow, we’re hosting a free virtual workshop for business owners.

We will cover 4 distinct levers to pull to unlock “hidden” cash in your business.

If you’re curious to learn more about how we scale businesses and help others do the same, we think you’ll find this workshop high signal-to-noise.

See you there? Last chance to save your spot here:

START HERE

How This Owner Identified a Bottleneck and Unlocked “$900k in Additional Revenue”

Jimmy Murray has a funny way of describing his career arc:

“I’m a millennial house hacker turned corporate dropout.”

Jimmy grew up in a blue-collar household. Union carpenter dad. Nurse mom working nights. “Basically, a single-parent household most of the time,” he said. “My dad worked seven to three. My mom worked until eleven.” Money was tight. “My dad was an awful cook. It was cereal, hot dogs, beans.”

What was consistent was his dad’s advice: “Don’t swing a hammer like me. Go to school.”

Jimmy did exactly that. Community college. Ohio State. A finance degree. Then Fidelity, where he stayed for 6 years. On paper, it looked like a great outcome. In reality, it felt hollow.

“Everyone’s like, ‘Oh man, Fidelity. That sounds sexy,’” he said.

“I was a financial analyst. I was going spreadsheet blind every day.”

“One, I hated it. Two, I got paid pretty well. But three, it set me up for what I do today because I got to experience a lot of things that I liked and didn’t like.”

In 2012, while still working full-time, Jimmy bought his first small multifamily property. A few months earlier, his grandfather, a World War II veteran and union plasterer, had asked him from a hospital bed, “Where do you think you’re going to go with the rest of your life?”

Real estate felt concrete and timely in the aftermath of the financial crisis. His dad hated the decision. “He told me, ‘That may be the biggest mistake you’ve ever made in your life.’”

But Jimmy began placing tenants. “My mortgage payment was $1,043 a month. I placed my first tenant at $900. The second at $950. I lived in one unit. I had an inherited tenant at $600.”

“I began to think about how to really make this work. At that point, I realized that I didn’t love the corporate world, but it did pay me well. So, how do I dig my tunnel out of Shawshank, so to speak?”

The answer was nights and weekends.

He started building a property management company on the side, learning everything the hard way. “I end up scaling it to a point where I’m able to sock away $100,000,” he told us. “At that point, I owned two four-unit multifamilies and a single-family in the countryside.”

Then he jumped.

“I quit my job making well over $100,000 a year for $30,000 a year to run a private property management company.” His last day was his son’s first birthday, and Jimmy has been doing this full-time for the eight years since.

Today, his company manages 1,100 doors, with 47 doors owned personally. The business generated $2.1M in gross revenue in 2024, not including $1.5M of subcontracted work.

But reaching that scale (and beyond) has required facing one major, uncomfortable truth…

THE PROBLEM

A $750,000 Bottleneck Hiding in Plain Sight

For years, Jimmy handled sales himself. Not because it was strategic, but because it worked.

“I spent about 25 hours a week in a sales capacity.”

Deals closed. Revenue grew. But growth was capped by his calendar.

At a Contrarian Thinking workshop earlier this year, our goal was to help Jimmy identify his company’s biggest constraint. It didn’t take long.

“They were like, ‘We’re going to help you uncover your biggest problem.’ And my office manager Mark looks at me and goes, ‘You know that you are the biggest problem.’”

Jimmy listened, and quite literally priced it out.

“I do coaching in the property management space. People pay me $250 an hour,” he said. “When I backed into the math, I realized I was looking at a roughly $750,000 problem.”

That number reflected his time spent on sales, and the opportunity cost of delayed growth and higher-leverage work left undone because the business still needed him on the phone.

“Just from listening to the Contrarian team, I realized I needed to fully automate myself out of certain things so I could focus on much larger opportunities. I began thinking about how to really systematize this.”

Here’s exactly what he did first: “I recorded every single sales phone call,” Jimmy told us.

Using a Plaud device, Jimmy transcribed the calls and reviewed them over several months.

“I took all the transcripts, dropped them into ChatGPT over the course of about three months,” he said. “And then I developed a one-pager that shared our entire value proposition.”

Sales stopped being instinctual and became repeatable. Only then did hiring further make sense.

Using Predictive Index, Jimmy also realized traditional sales archetypes weren’t a fit for his business. “Captains and Mavericks don’t really work because they’re super independent,” he said. “We realized we needed to hire an altruist.”

Once that key hiring was done and sales were no longer founder-dependent, Jimmy turned toward unit economics and client mix.

“Our top-line gross revenue in 2024 was $2.1 million,” he said. “That doesn’t include the $1.5 million we subbed out.”

“We also identified that the average multifamily door generates $2,494 in gross annual revenue,” Jimmy said. “So a typical three-family property produces roughly $7,500 a year in management revenue alone.”

But revenue per door wasn’t enough. Revenue per relationship mattered, too.

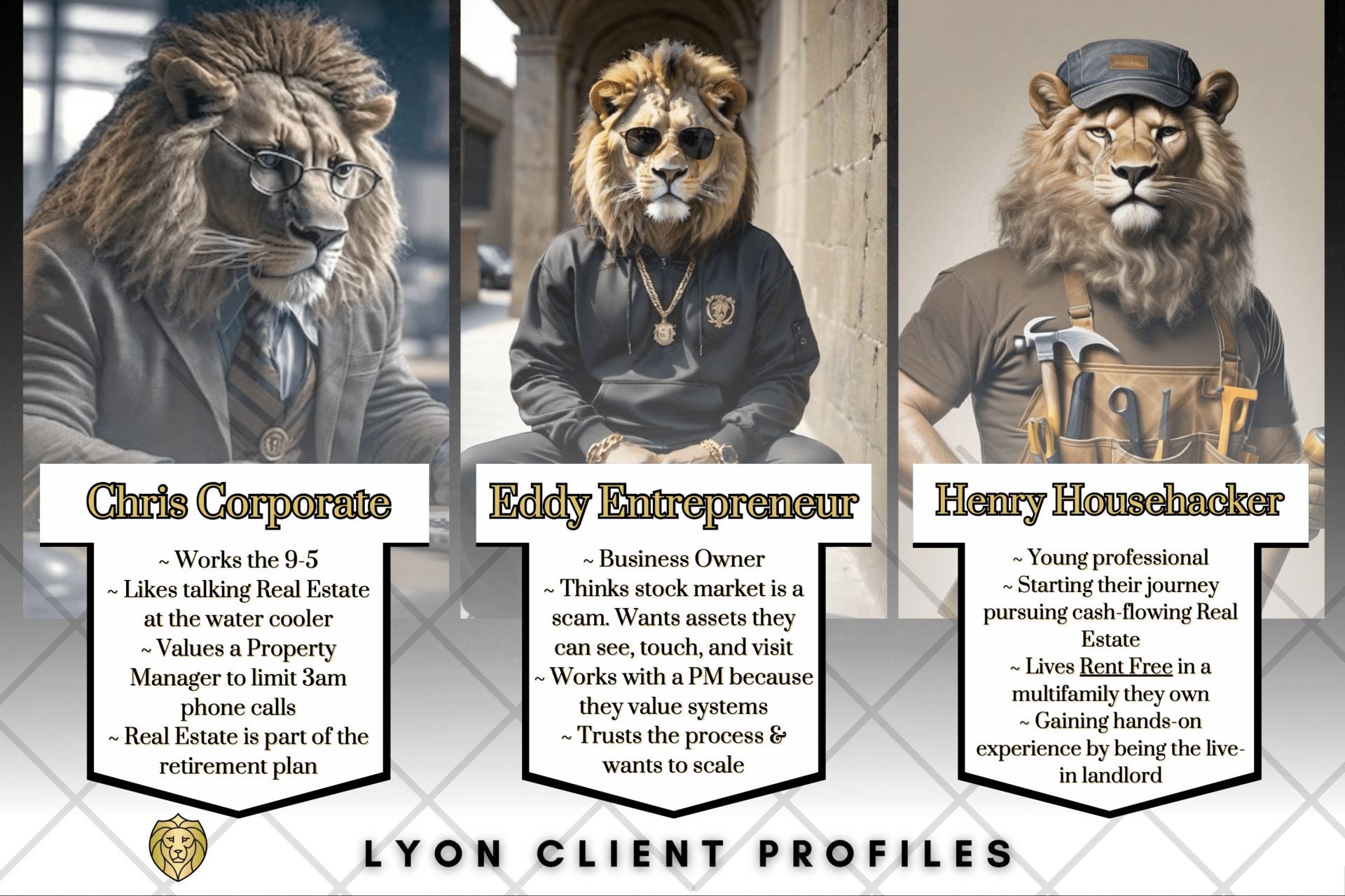

Originally, his business focused on three profiles: Eddie Entrepreneur, Chris Corporate, and Henry Househacker.

Provided by Jimmy

But during our workshop, a fourth avatar became clear:

“Sally Single.”

“A single-family house is $5,000 annually in gross revenue.” But at one client, one door, Jimmy didn’t love that ratio. “I’d rather have one client with 100 doors.”

Sally is profitable, but she’s not the kind of client who scales a property management business efficiently.

That realization helped reshape Jimmy’s go-to-market strategy, sales priorities, and growth focus, and the results have been remarkable.

KEY RESULTS

$934,000 in Signed Revenue, With More Pending

The impact of all this work has been measurable, according to Jimmy.

“We have signed contracts worth an annualized gross revenue of $934,000,” he told us. “I’ve already seen about 50% of that impact hit our top line this year.”

There’s more still working its way through the pipeline.

“We have several commitments on the fence where I think we’re going to get north of $1 million in additional gross revenue.”

Jimmy is explicit about what unlocked that growth.

“That all came from the scaling workshop. From hearing, ‘Here is the biggest problem, Jimmy,’ and then actually building the systems to fix it.”

Today, Jimmy’s company runs on EOS, the Entrepreneurial Operating System.

Property managers and agents own growth and owner relationships.

A virtual team handles routine resident needs.

Jimmy has also built in-house maintenance and is working to model his broader vertical integration strategy after operators who’ve added services like snow and landscaping.

But one of the things that matters most to him now isn’t tactics in isolation, but exposure to how other operators think.

“Inside the Growth Boardroom, I learn a lot through other people’s stories. If I can figure out where someone else is winning in a different industry and bring that back into mine, that’s how we create more value and innovation.”

“What I look forward to most is being an information sponge,” he says.

Want to join thousands of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join our Contrarian Academy or Growth Boardroom.

ONE MORE THING

Don’t Wait to Accelerate Your Acquisition Proficiency

Main Street Millionaire Live is our world-class, 100% virtual, 3-day technical intensive designed to compress the acquisitions learning curve.

Over 72 hours, we’ll immerse you in the mechanics of dealmaking: sourcing off-market deals, validating financials, negotiating with sellers, and structuring terms.

“This wasn’t just another hype-filled event. It was packed with real, actionable strategies and hands-on workshops. Codie and the team poured so much value into every session, and the energy in the room was next level.” -Adam C.

Main Street Millionaire Live is taking place February 20th-22nd. But our most affordable pricing (just $47) will likely end on January 5th. See you there?

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our partnership opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.