Welcome to The Main Street Minute, your shortcut to small business ownership.

👋 Shout-out to the new readers who joined the newsletter last week. Plus… huge shout out to everyone who joined us live at Main Street Over Wall Street 2025. Meeting so many of you in person was INCREDIBLE.

Expect PLENTY of lessons from the event in the weeks ahead. For now, though, let’s get down to business…

Today’s story: A husband-and-wife team with Big Tech roots chases a $1M+ virtual events company running on a little too much customer concentration.

Let’s dive in.

NUMBERS

The Deal on the Table

Every week, right here, we put 1 real small business deal under the microscope, straight from our community of business buyers.

The goal? You get to see how we break down the numbers, the story, the opportunities, and the risks.

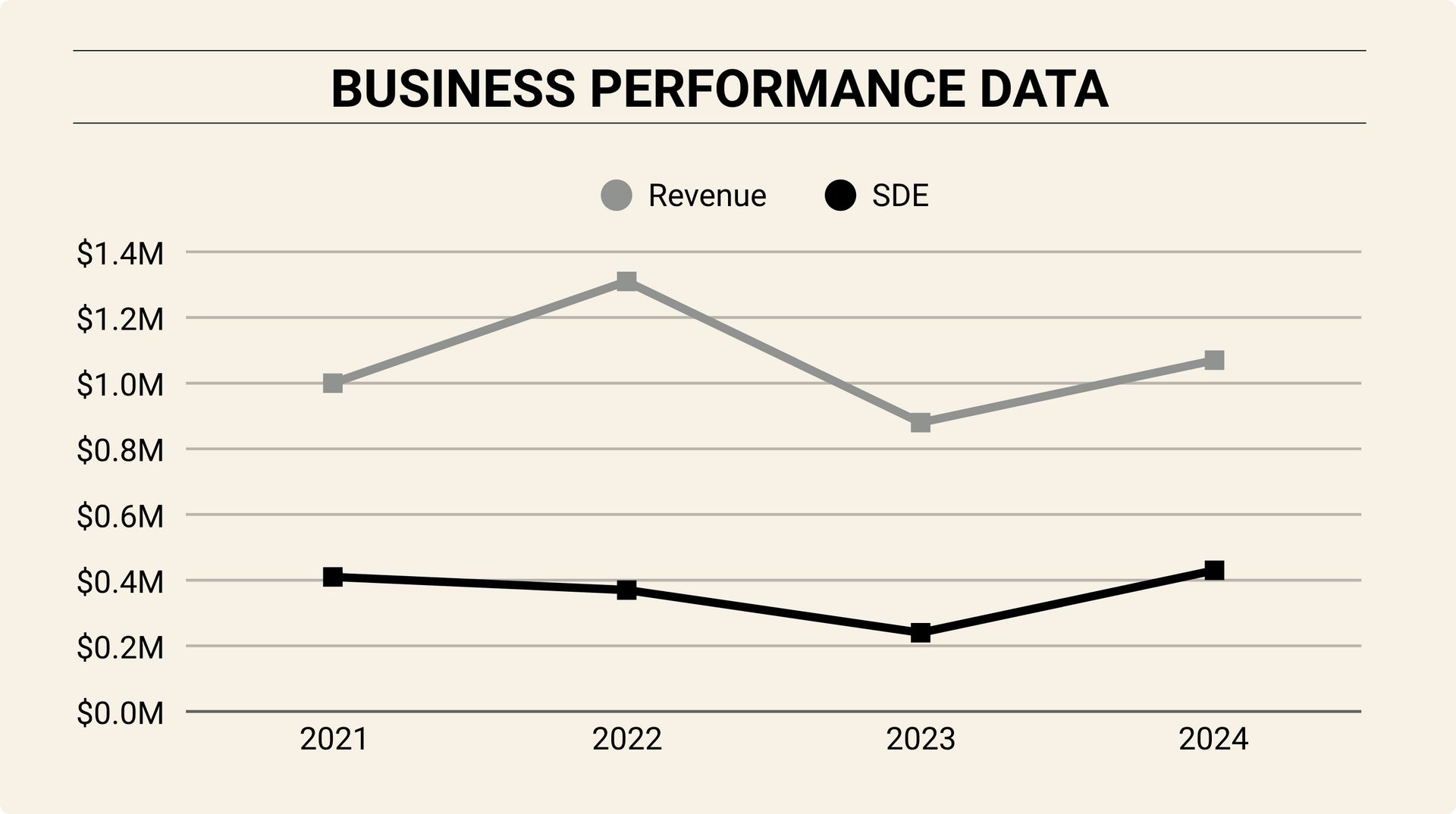

This week’s target: a corporate virtual events and gifting company doing about $1M in revenue and $430K in SDE.

The business carved out a niche running virtual experiences and gift boxes for distributed teams, mostly inside big tech companies.

The sellers (a husband-and-wife duo) built the business from scratch. Virtually all fulfillment is handled by a lean contract team: an ops manager, two part-timers, and a pair of virtual assistants. The company’s cash flow is strong, with a large portion of revenue prepaid upfront, and no paid ads to date (everything comes from referrals and word of mouth).

The prospective buyers are also a husband-and-wife team with decades of experience in Big Tech. Between them, they’ve worked across product, marketing, ops, and sales.

Their bet: that a remote, digital-first business like this could be scaled with a real focus on sales systems. They’re exploring a deal with seller financing, SBA financing, and cash, but the hurdles are big:

A 3x-4x multiple

A rocky 2023 slump

47% of revenue from one client

As one of our deal advisors put it:

The question now is…

Is this a scalable digital cash cow or a high-risk lifestyle business?

Let’s get to it…

KEY IDEAS

4 Lessons Any Buyer Can Steal From This Deal

When this company came up for review, the community focused on tricky questions many buyers face, but were hyper-relevant to this deal. Questions like:

Is this a scalable business or more of a lucrative side hustle?

What makes this business particularly risky to inherit?

How do you structure a deal for a business built on relationships?

Here’s what came out of the discussion.

1. Customer Concentration Can Kill a Deal

The business in question relies heavily on two clients. One makes up 47% of revenue, the other around 26%. That’s roughly three-quarters of the business tied to just two accounts. As one advisor put it:

Members agreed: Customer concentration isn’t a deal-killer by itself, but it should change how you price, structure, and protect your downside. One deal advisor summed it up bluntly: If you wouldn’t buy the business without those clients, you’re probably not buying a business, you’re buying a set of contracts.

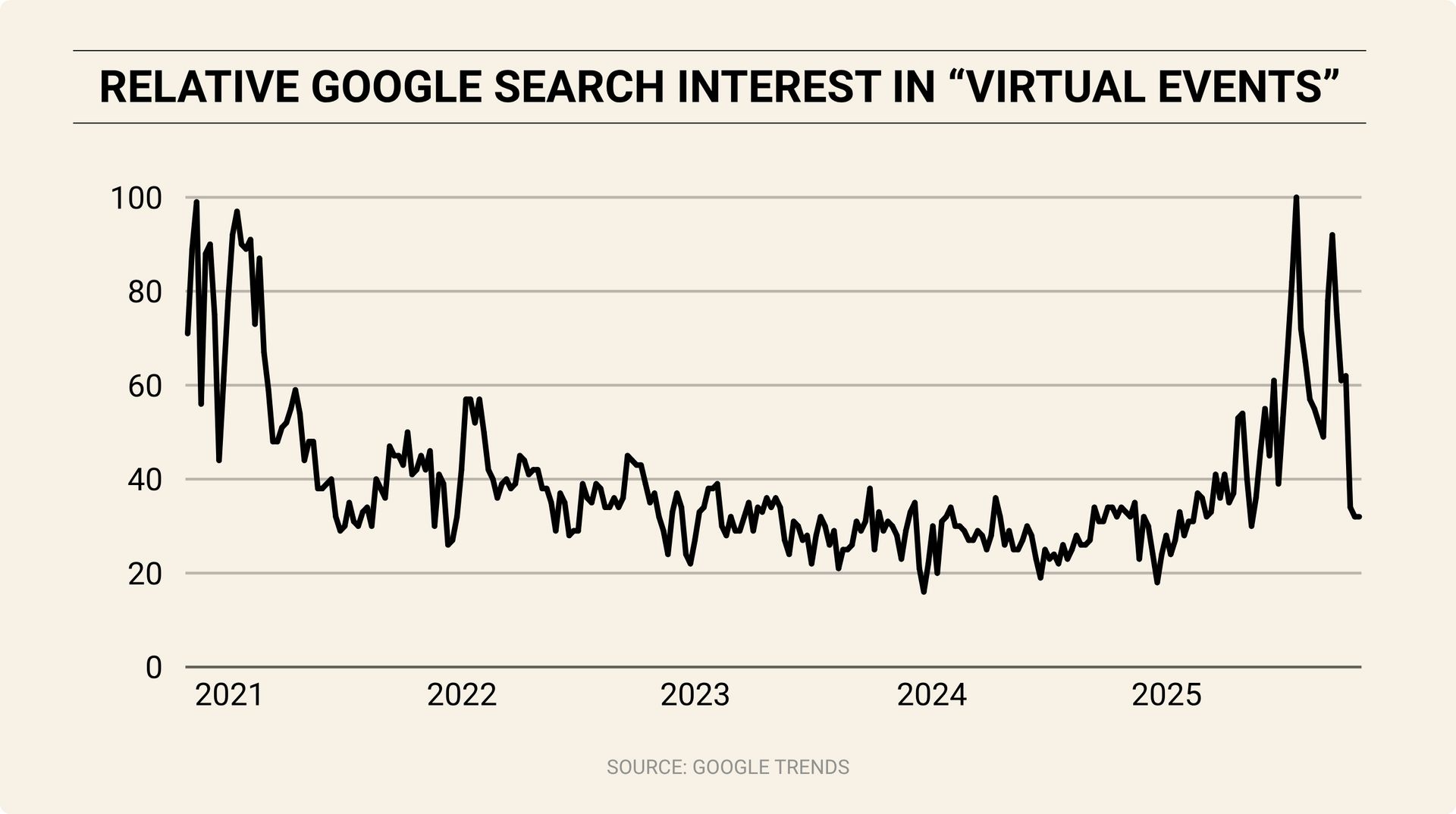

2. Virtual Events are a Growing (But Exposed) Industry

For this business, 2023’s financial drop-off was harsh. The sellers blamed the wave of tech layoffs and the “return to office.” But by late 2024, corporate teams were back to spending on experiences for remote and hybrid employees.

“2023 was the huge downturn. Forced return-to-office and tech layoffs hit them hard. That’s picked up since 2024.”

Contrarian Academy members agreed the story checked out, but it also underlined how exposed the company is to outside trends it can’t control.

3. A 3-4x Multiple Needs a 3-4x Moat

At $1.4M asking on $430K SDE, the valuation came in around ~3.2x. For a client-dependent company with seemingly no true moat, that made our acquisition advisors bristle. As one put it:

4. Buy Systems, Not Personalities

One Contrarian Academy member who joined the discussion had just walked away from a deal that looked almost identical: A small business with major customer concentration, no true sales function, and an owner-driven client base.

He explained that even though the numbers looked strong, he wasn’t willing to pay for revenue that could disappear the day after closing or new sales that he’d be responsible for.

“If those customers left, the whole business would tumble. I’d have to build some sort of proactive go-to-market and advertising strategy that doesn’t exist today. I wasn’t going to pay for things I’d have to build myself.”

So he restructured his offer to reflect that risk, tying the seller’s upside directly to customer retention. If those key accounts held, the seller got paid more. If not, the price adjusted lower.

That’s what a real mitigation strategy looks like: aligning incentives.

INDUSTRY

What You Need to Know

Data shows that over 60% of marketers expect to run more hybrid events this year, and over 70% say proving ROI is now their biggest challenge. In short, the industry’s maturing: fewer gimmicks, more measurement.

The result is a bifurcated market.

At one end: Massive platforms serving Fortune 500 budgets with enterprise-grade analytics.

At the other end: Small, boutique operators who win through creativity, personalization, and niche focus.

Everyone else risks being stuck in the middle: too big to feel intimate, too small to scale. When the buyers questioned about the potential to scale this business deeper into in-person events, the deal advisors expressed some reasonable caution:

The risk-reward here is fascinating: There’s a growing market, relatively low overhead, and clients willing to pre-pay for convenience and experience. But increasingly, as tools are automated and commoditized, the moat is trust, taste, and relationships.

For buyers like these, this is both encouraging and cautionary. The macro picture is strong, but the micro reality requires execution and positioning. Events players who can combine efficiency, scale, and data-driven ROI will define the next chapter.

With the information available, would you move forward on this deal?

THE BOTTOM LINE

What Happened Next?

After weeks of negotiation, the buyers reached the LOI stage. Lawyers lined up, lender pre-qualified, deal team assembled — and then made the call to walk away.

And what they learned could fill an entire playbook.

What Went Well

For these business buyers, the Contrarian Academy became their unofficial advisory board. Office Hours, deal reviews, and feedback from countless other buyers gave them new angles on deal structure, valuation, and process.

The results?

Theoretical concepts translated into real reps.

They entered the deal prepared, already partnered with a CPA, lawyer, and lender, with a pre-qualification letter in hand.

By the time this opportunity surfaced, they weren’t scrambling aimlessly. They were running a playbook they’d already studied.

“The LOI process was theoretical before our discussions. Actually going through it crystallized all the learnings.”

They also learned what makes a deal feel good versus what makes it fundamentally sound.

“We learned all about risk mitigation, specifically around customer concentration. That included seeing real-life examples we could apply to our own deal.”

And maybe the most rewarding lesson of all:

Better alignment, better clarity, and a stronger filter. With all that in hand, these buyers have already started scanning for the next opportunity, sharper for having gone through this one.

Want your deals reviewed by hundreds of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join the Contrarian Community.

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our sponsorship opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.