Welcome to The Main Street Minute, your shortcut to Main Street acquisitions.

👋 Shout-out to the dozens of new deal junkies who joined the newsletter last week.

This week: A buyer evaluates a puppy franchise with a good location and a manager in place, but declining revenue and risky unit economics raise concerns.

(If you’re looking to buy or sell a business, BizScout can help.)

DON’T MISS THIS

FREE: Learn How to Buy a Business That Pays You on Day One

On July 23, Codie Sanchez is hosting a free virtual masterclass for aspiring business buyers.

You’ll leave with The 10 Steps to Profitable Ownership, a proven roadmap to buying a cash-flowing business, with insight into:

Identifying the right business for you

Reducing the risk and spotting red flags

Acquiring without prior ownership experience

Learn in 90 minutes what most take years to figure out the hard way.

Now, onto today’s deal…

THE BUSINESS

Cute Product, Ugly Numbers?

Jake thought he’d found a simple, proven model: a puppy franchise with brand recognition, customers, and a staff already in place. Everything smelled like opportunity.

Until he opened the books.

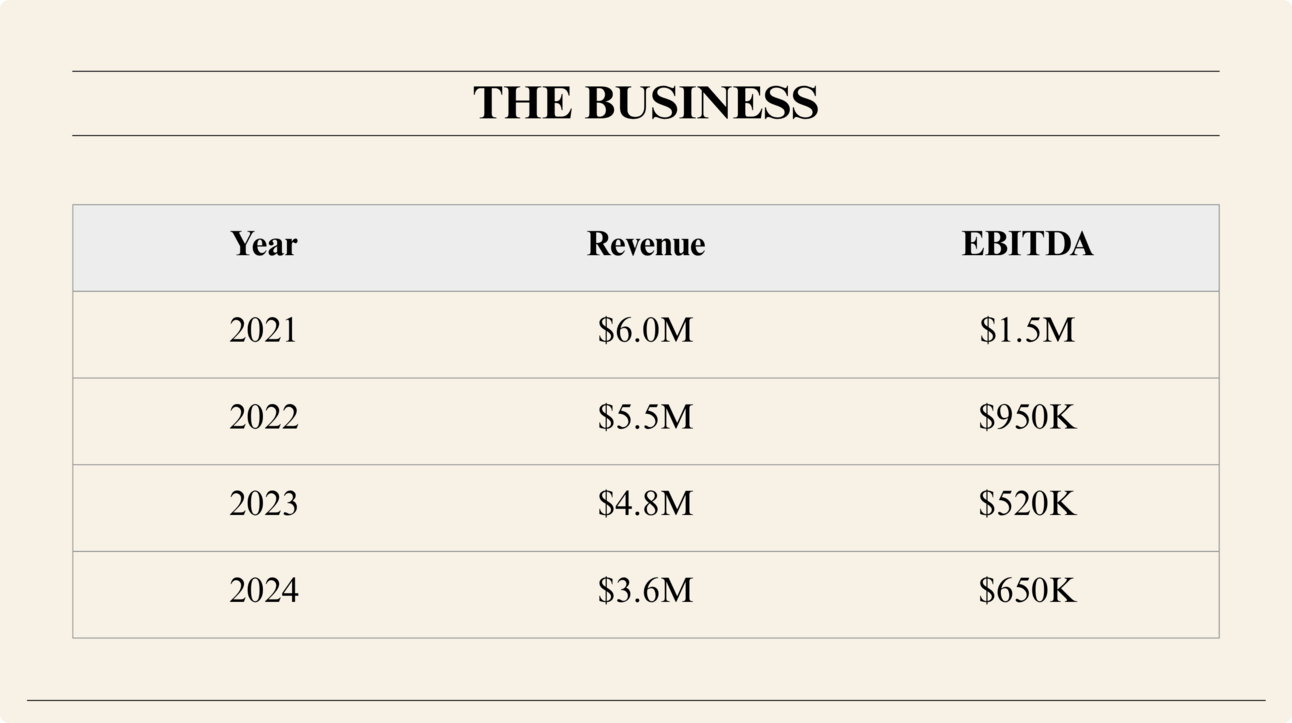

Over three years, revenue dropped by around $2.5M, and EBITDA was cut in half.

Jake dug deeper. More than 90% of revenue came from puppy sales. When he asked the broker about the decline, the explanation came fast: higher interest rates were making it harder for customers to finance their pets.

Still curious, Jake turned to our community’s deal calculator tool. He ran multiple scenarios. Even with a discounted offer of $2.3M, the numbers didn’t pencil.

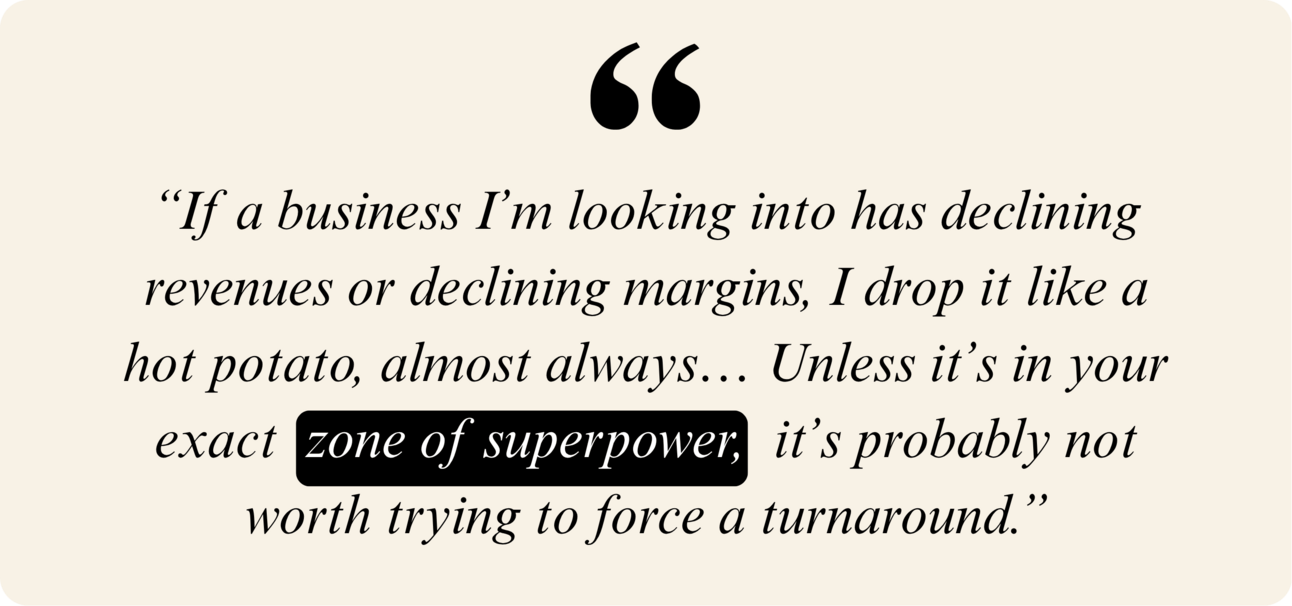

That’s when Jake started asking a new question: was it just this store… or is the model itself starting to unravel?

THE INDUSTRY

A Different Breed of Pet Retail

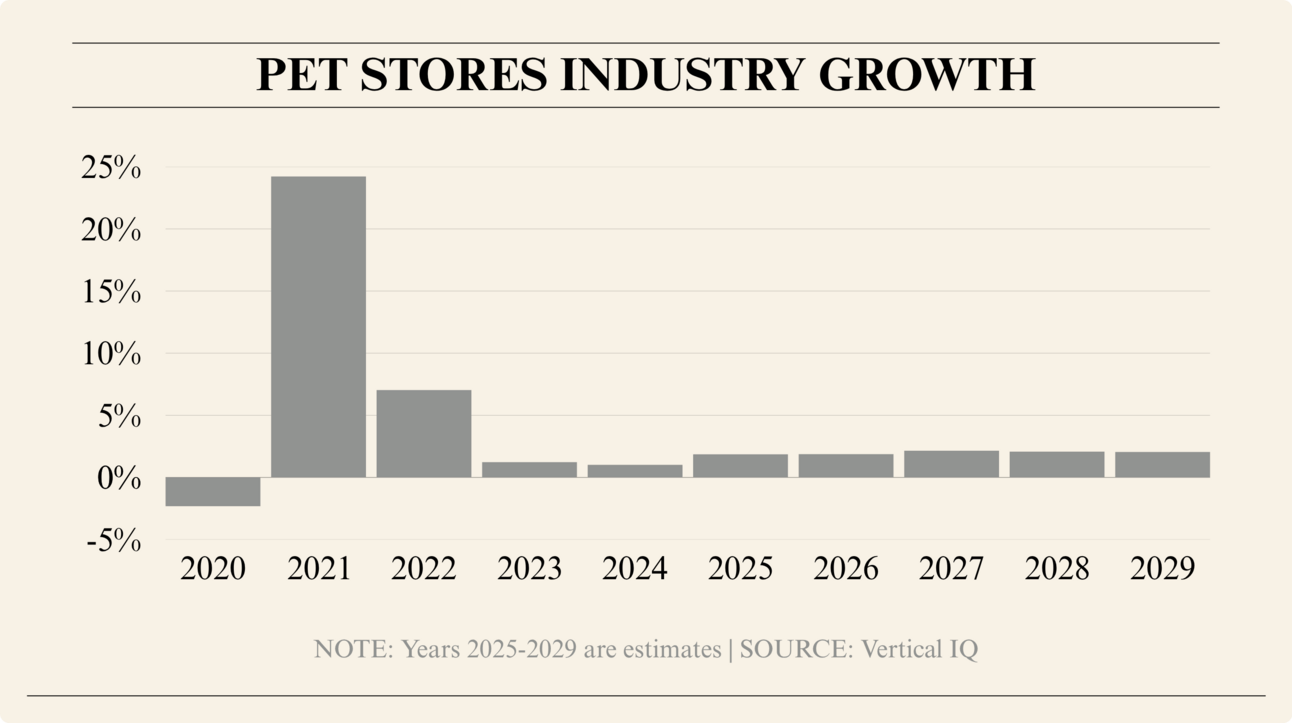

Pet services are a growing, $150B industry. But this business doesn’t follow the usual retail model. In most pet stores, live animal sales make up less than 5% of revenue. Here, puppy sales account for over 90%.

While most of the industry leans on food, supplies, and recurring services, stores like this depend on high-ticket purchases. That puts the business in a niche with different rules and risks.

A few structural headwinds are also likely to make growth harder:

Zoning rules can complicate overnight boarding in retail spaces.

Breeding oversight has tightened, and the term “puppy mill” now lives one viral TikTok away from reputational damage.

Labor costs are high — live inventory means well-trained staff and ongoing care.

And while the pet industry is known to be recession-resistant, it’s not immune. When consumer sentiment drops, buyers can look to cut discretionary spending, such as on new puppies.

Why Some Still See an Opportunity Here

Franchise models like this can offer a few key advantages:

Built-in brand recognition in a market with emotional buying decisions

Systems and vendor relationships that reduce operational chaos

Training and peer support, which many may find critically helpful

When run well, the economics can be strong.

But are they strong enough here?

VALUTION

Too Much Bark, Not Enough Bite

The broker told Jake this business’s price had “already drastically dropped drastically…” which made the reality even more bleak.

If revenue kept falling, he realized, there’s not enough cushion to safely cover debt payments. The deal would go upside down — fast. Our deal coaches and community members didn’t hold back on this:

Another coach questioned whether interest rates were really to blame for the revenue drop: “They’re dropping $1M a year in revenue… That may be just them throwing words out.”

A member flagged the need to go further back in the financials. This deal, he said, feels like it’s priced as if the COVID pet boom never ended, and the drop may just be the numbers normalizing.

Either way, another deal coach ran the numbers and came to the same place Jake did: “This is rough. We always say there's a price where it makes sense — maybe that’s true here. But it’s nowhere close to $3M. It’s not even close to $2.3M. It’s like a $1.3 to $1.5M deal at most.”

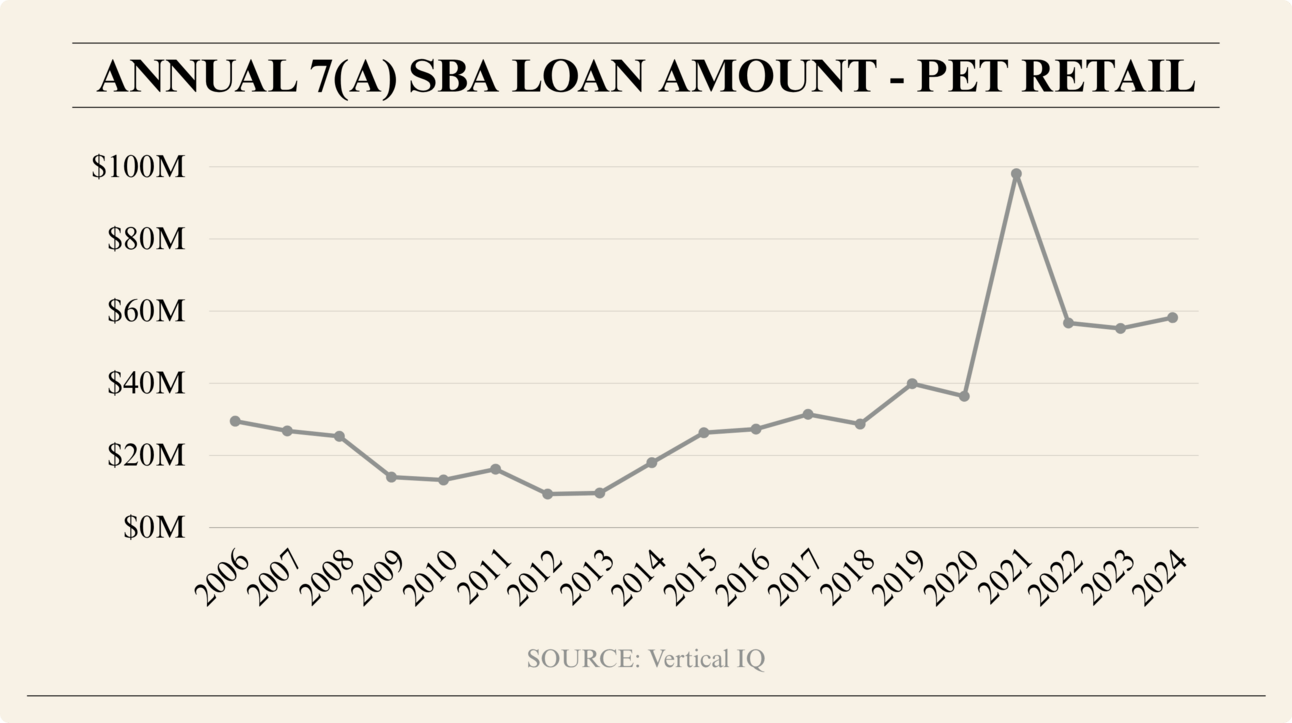

And the broader market? It backed the community up.

According to Vertical IQ, the median price to EBITDA multiple is 3.93x for pet businesses. This deal was asking for closer to 5x — on a business with shrinking sales and rising uncertainty.

Others pointed to comps in the same franchise category that can be started for ~$500K, with more predictable margins and none of the baggage.

The verdict? Jake summed it up well: There may be a price where this deal pencils. But this ain’t it.

Want your deals reviewed by hundreds of smart business builders and buyers?

Get access to our live expert calls (and so much more) when you join the Contrarian Community.

With the information available, would you move forward on this deal?

What’d you think of this week’s newsletter?

It makes our day to hear from you. Let us know what you thought of this week’s newsletter by replying. We read every response.

Oh, and tell others to sign up here.

Want your brand in front of thousands of business buyers?

Check out our sponsorship opportunities.

Want more where that came from?

Head to our website.

Disclaimer: Be an intelligent human and make responsible choices. There are zero guarantees in life. Read our Terms of Service, Privacy Statement, DCMA Policy, and Earnings Disclaimer before you make any financial or investment decisions.